An accounting meeting is a scheduled gathering where stakeholders of a company or organization come together to discuss and review financial information and reports. During this meeting, accountants, executives, managers, and other relevant parties analyze the financial health of the company, discuss any issues or concerns, make strategic decisions regarding budgets, investments, and financial planning, and ensure compliance with accounting regulations and policies. The meeting may involve presenting financial statements, profit and loss reports, balance sheets, cash flow statements, and other relevant financial data to provide a comprehensive overview of the company’s financial position.

What is the purpose of a Accounting Meeting?

The purpose of running an accounting meeting as a leader is to review and analyze financial information, ensure accuracy and compliance, make informed decisions, and communicate effectively with team members. It helps in planning and monitoring budgets, improving financial performance, and fostering transparency and accountability within the organization.

How To Run A Accounting Meeting: Step-By-Step

- Step 1: Determine the Meeting’s Goals

- Step 2: Identify the Right Participants

- Step 3: Create an Agenda

- Step 4: Circulate the Agenda

- Step 5: Prepare Financial Reports

- Step 6: Set up the Meeting Space

- Step 7: Conduct the Meeting

- Step 8: Record the Minutes

- Step 9: Review Action Items

- Step 10: Close the Meeting

1

Step 1: Determine the Meeting’s Goals

Decide what specific financial concerns you want to address, evaluate the current financial health of the company, and strategize for future accounting periods in order to set clear objectives for the meeting.

Next Step

2

Step 2: Identify the Right Participants

In addition to the accounting team, managers, executives, and external stakeholders should attend the meeting to ensure that all key individuals are informed about the company’s financial situation and can participate in decision-making processes.

Next Step

3

Step 3: Create an Agenda

During the meeting, key topics to be discussed include reviewing financial statements, addressing budget deviations, planning for future financial periods, and any other financial matters that require attention or decision-making.

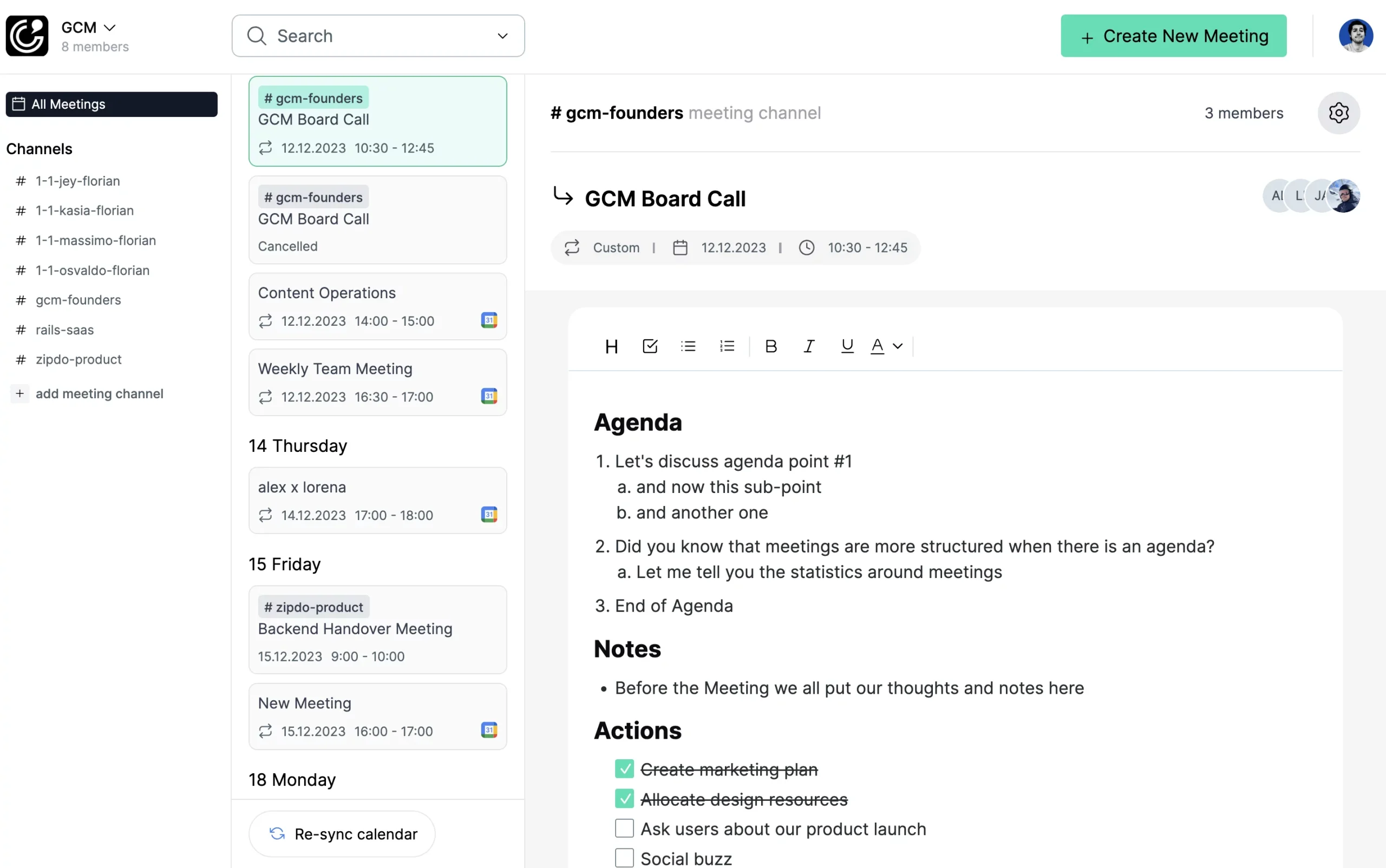

Our platform, ZipDo, facilitates the integration of calendar appointments into a single collaborative space. This space is dedicated to constructing a joint agenda, where every team member has the opportunity to add their topics. By doing so, it guarantees more comprehensively prepared meetings, optimizing efficiency and easing the preparation and follow-up stages.

Recommendation

Advertisement

Have you tried our Meeting Notes Software, yet?

Want to run a better meeting? Try ZipDo, our Meeting Note Software.

Connect your Google Calendar

Automatically create a note for every meeting

Organize your meetings and meeting notes in a channel like Slack

Next Step

4

Step 4: Circulate the Agenda

It is essential to distribute the meeting agenda ahead of time to all participants. This enables them to prepare adequately, bringing any required materials or data. Their proactive involvement will contribute to a more efficient and productive meeting.

Our app, ZipDo, imports all meetings from your calendar and creates a collaborative workspace for each appointment. Here, you and your team can compile a shared meeting agenda, where all team members can add their topics. This ensures that meetings are much better prepared by everyone in your team, making your meetings more efficient. It also simplifies the preparation and follow-up of meetings.

Next Step

5

Step 5: Prepare Financial Reports

As a business expert, it is essential to gather and organize financial data and summaries. These invaluable resources serve as crucial references and evidence to add depth and credibility to the discussions held during the meeting.

Our application, ZipDo, simplifies the process of preparing for team meetings. Meeting leads can quickly retrieve all relevant information from past sessions, including agendas and notes, stored in one place. This facilitates a smoother preparation process and guarantees no key points are missed.

Next Step

6

Step 6: Set up the Meeting Space

In order to determine where the meeting will take place, consider factors such as the purpose of the meeting, the number of participants, and any technological requirements. Choose between a physical location or a virtual video conference room that can accommodate the needs of all attendees.

Next Step

7

Step 7: Conduct the Meeting

At the start of the meeting, ensure you cover all agenda items, making sure each point is addressed. Facilitate open, productive discussions and emphasize the importance of transparent communication among participants.

Next Step

8

Step 8: Record the Minutes

Select a designated note-taker for the meeting who will effectively capture essential details such as key decisions, action items, and vital discussion points in a clear and concise manner.

With ZipDo, our creation, meetings from your calendar are automatically organized into a collaborative space. Here, you and your team can easily share notes, making meeting preparation and follow-up more straightforward and fostering greater accountability among team members.

Next Step

9

Step 9: Review Action Items

Towards the end of the meeting, it is important to review the action items and ensure that responsibilities are assigned to each participant. This will ensure that everyone is clear on their tasks going forward.

Next Step

10

Step 10: Close the Meeting

Conclude the meeting by providing a recap of the key points discussed and clearly stating the upcoming actions that should be undertaken in order to move forward effectively.

Questions to ask as the leader of the meeting

1. What are the current financial goals and objectives of the organization? – This question helps to set the context for the meeting and ensures that everyone is clear on the financial targets and priorities.

2. How are we tracking against our financial goals? – This question allows the leader to assess the progress and identify any areas of concern or success in relation to the organization’s financial performance.

3. Are there any significant financial risks or challenges that need to be addressed? – This question helps to identify potential threats to the organization’s financial stability and allows the leader to develop appropriate strategies to mitigate these risks.

4. What key financial metrics and indicators should we be monitoring? – This question helps to ensure that the right financial performance indicators are being tracked and analyzed, allowing the leader to make informed decisions and adjustments as needed.

5. Are there any opportunities for cost-saving or revenue generation that we should explore? – This question prompts the team to think strategically about ways to improve financial performance and identify potential areas for improvement or investment.

6. Are there any emerging financial trends or industry changes that may impact our organization? – This question encourages the team to stay informed and adapt to the evolving financial landscape, helping the organization to proactively navigate any potential challenges or take advantage of new opportunities.

7. What is the financial health of our key stakeholders, and how might it impact our organization? – This question helps the leader gauge the financial stability of external partners, suppliers, or clients, and understand how any potential financial issues could affect their own organization.

8. What is our expense allocation and budget utilization? – This question helps the leader assess how effectively resources are being allocated and if there are any areas where costs can be reduced or reallocated to achieve better financial outcomes.

9. How can we improve our financial reporting and communication processes? – This question focuses on identifying areas for streamlining financial reporting, ensuring accuracy, and enhancing transparency within the organization.

10. What are our long-term financial sustainability plans? – This question prompts the team to think beyond short-term objectives and consider the organization’s financial sustainability, ensuring that appropriate strategies are in place for future growth and stability.

Learn how to prepare a Accounting Meeting

As a leader, preparing an accounting-meeting agenda requires careful consideration. Start by identifying the main goals and topics to be discussed. Set a realistic time frame and allocate sufficient time for each item. Include key financial reports, updates, and any required decisions. Lastly, distribute the agenda well in advance and encourage team members to come prepared.

How To Prepare For A Accounting MeetingExemplary Agenda Template For: Accounting Meeting

Topics that should be discussed in an accounting meeting include financial reports, budgeting, expense analysis, tax planning, cash flow management, regulatory compliance, and any relevant updates on accounting standards and policies.

See Our Accounting Meeting TemplateSoftware tools to facilitate a Accounting Meeting

With the help of software, leaders are able to run accounting meetings efficiently. Software automates the process of financial data collection, analysis, and presentation, enabling leaders to access accurate and real-time information. It streamlines tasks, reduces human error, and provides valuable insights, empowering leaders to make informed decisions and effectively communicate financial updates during meetings.

Our Recommendations:

- Meeting Management Software: A software that can help you organize your meeting workflow

- Meeting Agenda Software: A software that helps you to collaboratively create meeting agendas

- Meeting Notes Software: Software that allows you to create notes during meetings

- Meeting Minutes Software: A software that helps you preparing meeting minutes for your team.

Conclusion

Running an accounting meeting can seem daunting, but with careful planning and execution, it can become a valuable tool for financial success. By setting clear objectives, preparing an agenda, and using effective communication techniques, you can ensure that your accounting meetings are productive and efficient. Remember to encourage meaningful participation from all team members and foster a collaborative environment. Additionally, documenting meeting minutes and following up on action items will help maintain accountability and drive progress. With these strategies in place, you can cultivate a culture of transparency, accuracy, and efficiency within your accounting department. So, go ahead and put these tips into practice, and watch as your accounting meetings become indispensable vehicles for financial success.

Jannik Lindner

I'm Jannik and I write on MeetingFever about the experiences from my career as a founder and team lead.

If you have any questions, please contact me via LinkedIn.

Popular Questions

What are the main topics we will be covering in today's accounting meeting?What financial period are we reviewing today?Who will be presenting the budget assessment report?Are there any serious issues revealed from the internal audit findings?Are there any new accounting regulations or tax laws that we need to consider in our financial planning?

We will be discussing the financial statements, budget assessment, cost management strategies, tax planning, and internal audit findings.

We are going to review the last financial quarter, from January to March.

Our senior financial analyst, will present the budget assessment report.

There are no serious issues to address; however, there are a few irregularities that we need to discuss and find the best possible solutions.

Yes, there’ve been some recent changes in tax laws that will affect our financial planning and we will discuss these changes in detail during this meeting.